👋 Welcome to Climate Drift: your cheat-sheet to climate. Each edition breaks down real solutions, hard numbers, and career moves for operators, founders, and investors who want impact. For more: Community | Accelerator | Open Climate Firesides | Deep Dives

Hey there! 👋

Skander here.

Two weeks ago we dropped the FOAK Field Guide and the inbox lit up like a refinery flare:

“I’m still at square zero: what even is FOAK?”

“I’m knee-deep in my first build: got anything spicier?”

“How do I prep for the live Open Climate session on the State of FOAK next week?”

Short answer: Starter Packs. No matter if you are a beginner or an expert on a topic, our starter packs are the content drops for you. We hand them out in our accelerator on every solution area, we have them in our community, and now you get them.

It’s explainers, it’s deep dives, it’s interviews, it’s case studies. No matter which content type you like to consume: all curated to get you up to speed.

Everything’s < 3 years old unless it’s an untouchable classic, and we’ve sliced the list by experience level so you can jump straight to the good stuff.

🌊 Let’s dive in

Next week we are organising a 60-minute live Open Climate session to discuss the state of FOAK with four operators who’ve actually crossed the valley: finance pro Deanna Zhang, driftie Nik Baumann, gigaton-scale engineer Tim Woodcock, and Third Derivative’s MD Rushad Nanavatty.

We will trade war stories on funding gaps, manufacturing hell, policy whiplash, and the million-dollar mistakes nobody posts on LinkedIn; zero fluff, zero sales pitches, just hard-won insight, rapid-fire Q&A, and a few FOAKing bad puns.

The FOAK Starter Pack

This is one to save and to forward. Click on the headline to read it in full 👆

Beginner: “FOAK? What’s that?”

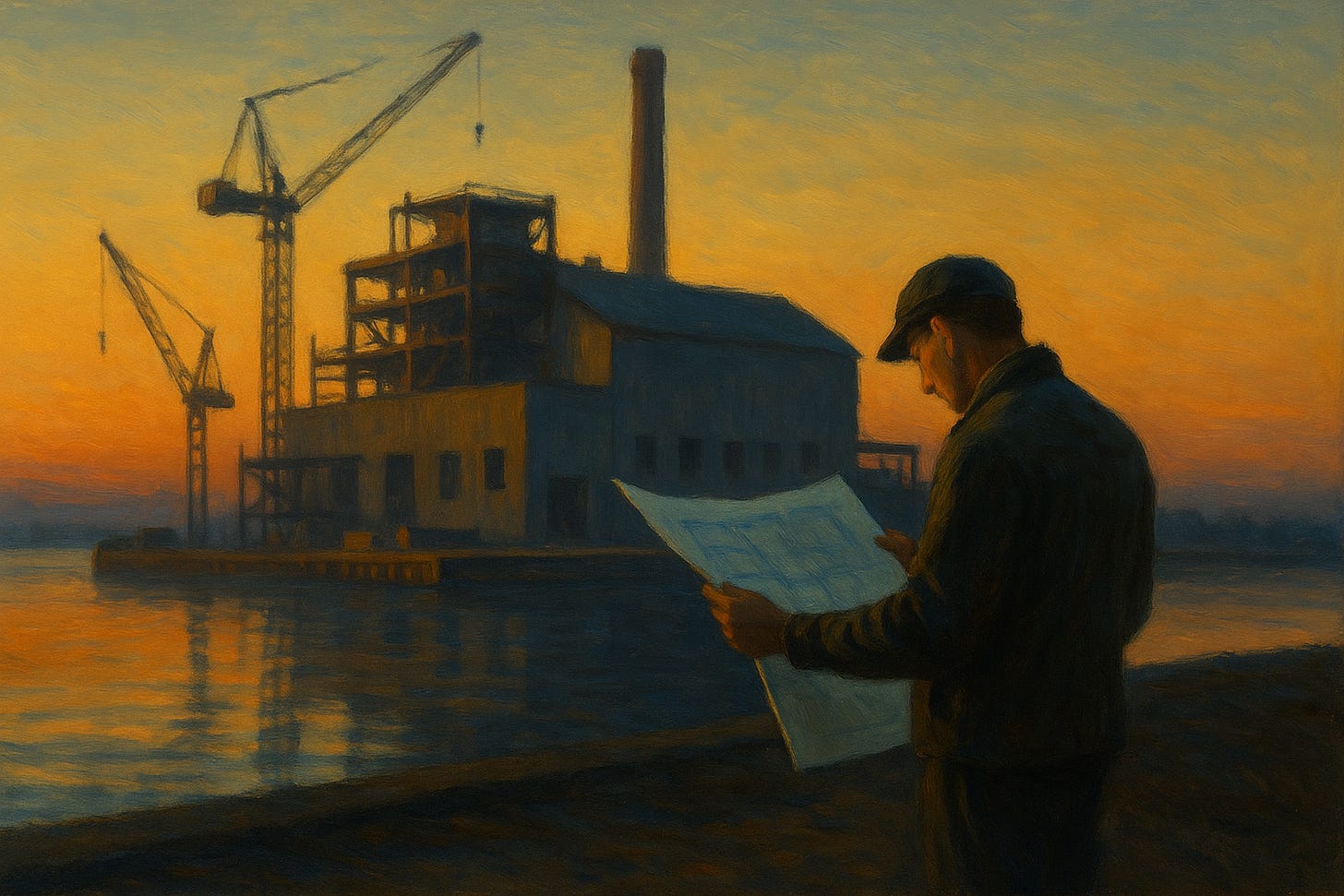

First-of-a-kind is the moment a climate technology hauls itself out of the lab and cannonballs into the deep end of real-world complexity. Lab prototypes are tidy; full-scale plants are chaotic. Tiny heat-transfer hiccup at 5 kW? That’s a multi-million-dollar shutdown at 50 MW.

Start with our own explainer of Technology Readiness Level:

“The FOAK Question: Essential Insights for Financing and Planning First-of-a-Kind Plants” – Yair Reem, Extantia (2023):

A guidebook-style article breaking down everything a newcomer should know about FOAKs. It spells out FOAK as the step where your tech “leaves the sterilized lab and takes on the real world,” bridging the gap between idea and actual commercial operation. Covers why FOAK projects are daunting (big costs, new risks) and how to approach planning one. If you’re looking for a founder-oriented explainer with practical advice (how to size your first plant, what to test, when to line up offtake agreements), start here.

👉 Read it here

Catalyst with Shayle Kann Podcast: “Financing First-of-a-Kind Climate Assets” (2023):

An accessible conversation that illuminates why FOAK projects are so challenging to fund. Host Shayle Kann and climate finance veteran David Yeh unpack the “missing middle” between venture capital and project finance. They explain in plain language why traditional VC is too expensive for building actual plants, but banks won’t touch unproven tech. Hear about real examples (sustainable aviation fuel, geothermal, direct air capture) and how some companies cracked the FOAK funding puzzle. Perfect for a beginner to grasp the financial gauntlet every FOAK runs and why new funding models are emerging to bridge that gap.

👉 Listen here

Intermediate

“Starting our first FOAK, and it’s a rollercoaster.”

You’re knee-deep in planning your first full-scale project. You’re wrestling with massive capex, partner selection, pilot data, permits, and timelines slipping right and left. Welcome to FOAK hell. Don’t worry, you’re not alone.

The FOAK Field Guide– Nik Baumann, Climate Drift (2025):

Fresh off the press and founder-focused. This piece calls FOAK “the toughest stretch for climate tech” and lays out exactly why. From capital gaps to permitting hell to team “readiness” issues, it catalogs the blockers that can derail your first plant. Crucially, it offers a roadmap for founders and funders to build “Fit-for-FOAK” projects that survive and scale. Expect hard-won insights on preparing your team, lining up financing (and backup financing), managing engineers & construction, and keeping investors on board when the budget 2x’s. If you only read one guide on executing a FOAK, read this.

👉 Read it here

FOAK Financing: The Good, The Bad, and The Eligible – CTVC (2024):

A super tactical breakdown of how to fund that first big project. It acknowledges you’re “ready to build” and now “up next: raise eight to nine figures” – which is exactly your dilemma. The article then walks through five financing sources (equity “super round,” strategic partners, government grants/loans, catalytic/philanthropic capital, and project finance) and what each is looking for. It’s basically a FOAK funding cheat-sheet: for each capital source, learn the Good (pros), the Bad (cons), and what makes you Eligible as a FOAK-stage company. This is full of real examples (companies that nailed each funding route) and frank advice (e.g. government money isn’t worth it for tiny projects; project financiers care about IRR and offtake agreements)

👉 Read it here

Catalyst with Shayle Kann Podcast: “FOAK Tales” (2025):

FOAK war stories and lessons from the front lines. Host Shayle Kann interviews Mario Fernandez, who runs Breakthrough Energy’s FOAK financing program (the folks who helped fund Form Energy’s batteries, Rondo’s heat storage, Lanzajet’s SAF, etc.). This episode is a masterclass in going from first pilot to first plant. They cover why infrastructure investors are so skeptical until you can show a repeatable template of projects, and how to chart a path from pilot → demo → FOAK → Nth-of-a-kind. Key insights for you: how to structure offtake deals that both secure a customer and leave you flexibility, how to assemble a capital stack (mix of equity, debt, grants) that actually closes, and how to not run out of money before the thing is built. If you need inspiration and practical tips from someone who’s seen dozens of FOAK attempts, tune in.

👉 Listen here

Want to dive deeper in one of these case studies? We have you covered on Rondo & the State of SAF

Expert

“Building one FOAK, now onto round two.”

You are surviving at least one FOAK project. Battle scars include wrangling EPC contractors, sweating out procurement delays, begging suppliers and customers to stick with you, and navigating policy incentives (or sudden policy changes). You know the first plant was only the start: now comes scaling production, driving costs down, lining up project #2, #3…#10, and evolving your org from a single-project startup to an actual company.

Five Lessons for Industrial Project Finance from H2 Green Steel – RMI (2023):

An insightful case study of scaling a FOAK into an industry cornerstone. H2 Green Steel (Sweden) went from founding in 2020 to raising €5B+ for its first-of-a-kind green steel plant. This RMI piece distills how they pulled it off and what financing framework emerged. Lessons include: blending equity with export credit agency debt, leveraging strong government support (permitting and infrastructure in northern Sweden), securing firm offtake contracts from big customers to de-risk the revenue, and treating your FOAK as a template.

👉 Read the lessons here

Learning from Case Studies: Financing & Development Approaches from Recent First-of-a-Kind Projects — DOE Office of Clean Energy Demonstrations, Portfolio Insights (2024):

Eight FOAK developers, spanning low-carbon steel, cement, chemicals, SAF, efficiency, and CDR, opened their deal rooms to OCED. The resulting 40-page autopsy reads like a field manual for turning “not yet bankable” ideas into financeable reality. Two headline truths frame the report: (1) a FOAK business model demands relentless creativity and iteration, because vanilla project-finance templates simply don’t fit new tech, and (2) your capital stack, offtake design, and risk allocation must mirror sector-specific demand signals and tech maturity.

👉 Dive into the case studies here

The Risk of Scaling 100× — The Green Blueprint (2024):

Let’s dive deeper in one case study: Via Separations’ CEO Shreya Dave walks host Lara Pierpoint through the gut-check decision to skip a safe 10× pilot and leap straight to a 100× first-commercial membrane system at an Alberta paper mill. The conversation is a FOAK master-class in speed-versus-risk trade-offs: why fixed-cost items (pumps, tie-ins) made the smaller build just as slow but far less meaningful to the customer; how a 90-percent-grant-equity-equipment-loan stack replaced the project-finance that didn’t yet exist for unproven tech; and why serving as your own general contractor can shave 18-plus weeks of lead time—at the price of re-work and exposure to cost overruns.

Why Lenders Aren’t Looking at Your Climate Project — Mairi Robertson(2025):

When equity dollars dry up, founders often expect infrastructure lenders to ride to the rescue but Mairi Robertson shows why most FOAK deals still die in the inbox. She frames the Three Gates Problem:

Gate 1: returns: lenders need 15–20 % unlevered IRR at the asset level, with at least 5–7 points of “excess spread” above borrowing costs;

Gate 2: runway: a full 12 months of cash (not promised Series B money) to survive stacked J‑curves and permitting surprises ;

Gate 3: ticket size: a credible path to deploying $20 M+ within 24 months, because diligence costs are fixed and lenders need volume to justify the work.

Each gate maps to a deeper principle predictable cash flows, operational stability, capital efficiency—and the article closes with a blunt checklist: detailed asset‑level models, staged draw‑down schedules, and a risk‑mitigation playbook before you ever hit “send” on that term‑sheet request

Thanks for reading! Know someone who should get up to speed on FOAK ? 👉 Forward this starter pack to them or send them the Open Climate Fireside. Let’s grow the circle of doers.

For more: Community | Accelerator | Open Climate Firesides | Deep Dives