👋 Welcome to Climate Drift: your cheat-sheet to climate. Each edition breaks down real solutions, hard numbers, and career moves for operators, founders, and investors who want impact. For more: Community | Accelerator | Open Climate Firesides | Deep Dives

Hey there! 👋

Skander here.

Repair isn’t just an ethical choice, it’s a high-leverage business model hiding in your returns bin.

In today’s deep dive, Driftie Molly, circularity strategist, field operator, and supply chain expert, makes the business case for repair. Not recycling. Not offsets. Not wishful sustainability theater. Repair.

She’s worked with everyone from Nespresso and Google to local farmers and tailors across 20+ countries. Now, she’s pulling back the curtain on how brands can future-proof their products (and their profit margins) by making repair a core business model:

Why repair beats resale, rental, and even recycling on circular impact

What Veja, Apple, REI, Rab, and Framework are doing right (and what most brands still get wrong)

How to build a repair-first strategy from pilot to scale (without sinking your ops team)

The real reason your desk lamp is unfixable

If you care about building durable brands for a decarbonizing world, this essay is a masterclass.

🌊 Let’s dive in

But first, who is Molly?

Over 13 years working in international economic development she has guided entrepreneurs and multinational firms in more than 20 countries, helping them turn climate risk into profitable business opportunities. Her projects have mobilised USD 85 million, grown profits for more than 500,000 producers and small business owners, and driven supply-chain efficiencies that cut both emissions and costs.

She helps brands turn sustainability goals into profitable actio, blending data, market insight, and field experience. From carbon-neutral supply chains to circular packaging deals, she specializes in product-as-a-service and regenerative sourcing, using smart strategy and strong storytelling to drive investment and change

Highlights include working with a multi-million dollar portfolio of coffee farmers in South Sudan, Ethiopia, Kenya and Rwanda on AAA certified production to supply Nespresso’s Reviving Origins product line, a climate smart innovation acceleration programme focusing on market segmentation, business model piloting and customer acquisition in Thailand and a Google-backed anticipatory-cash pilot that shielded at-risk communities in Nigeria from extreme weather.

The business of repair

This is one to save and to forward. Click on the headline to read it in full 👆

The Weight of Waste: My Personal Perspective

In my daily life, one constant source of disappointment is throwing something in the trash. My career in international economic development has deeply shaped these feelings and practices.

Over more than a decade working across global supply chains, I’ve met thousands of people who labor tirelessly to meet global consumption demands, from staple foods to luxury goods. I’ve stood on rice farms in Thailand, coffee farms in Kenya, and cotton fields in Chad. I’ve visited cobalt and diamond mining towns in the Democratic Republic of Congo and sapphire mining towns in Madagascar. I’ve walked factory floors in Tajikistan and toured cashew processors in Côte d’Ivoire.

Each visit revealed the immense labor, materials, and logistics behind the goods we so easily discard. I remember my astonishment at a cashew processing plant in Côte d’Ivoire, witnessing the countless steps required to transform a raw nut into a clean, shelled product for grocery shelves, and what I saw didn’t even account for farming, transport, packaging, or retail. Every t-shirt we wear, smartphone we use, and meal we consume represents months, sometimes years, of manual labor and natural resource extraction, not to mention the logistical and operational strain of turning raw goods into marketable products.

These personal encounters with the people and places behind the supply chain sparked a broader realization: waste is not just a personal concern, but a systemic global challenge that touches every corner of our economy. They shaped my professional mission to help businesses rethink their relationship to waste.

The Waste Crisis We Created

In a world increasingly overwhelmed by waste, throwing something away has become a daily moral dilemma. While policies, prices, and shifting consumer values are beginning to steer us toward sustainability, brands play a powerful role in making circularity the default. Every discarded product is not just a sustainability failure—it’s a missed opportunity to strengthen brand loyalty, retain value, and build meaningful customer engagement.

This piece explores the urgent need to shift from the linear “take-make-waste” model to one that embeds durability, accountability, and intentional design into business strategy. It also highlights the growing influence of consumers, companies, and policy in making circularity both possible and preferable.

The Take-Make-Waste Model: An Economy Built to Discard

Our global economy still runs on a linear system: extract resources, make products, and dispose of them, often after a single use. While this “take-make-waste” model has fueled decades of growth, it is now driving a crisis of overconsumption, environmental degradation, and resource depletion.

Food, textiles, packaging, and electronics, the core of modern consumption, are among the biggest contributors to landfill overflow and greenhouse gas emissions. Without intervention, global waste is projected to increase by 70% by 2050, with material consumption doubling by 2065. This outcome is not simply the result of consumer carelessness, but of an economic system designed for waste.

“We are not using material and resources efficiently in our current economy, we extract a lot of resources, we process it to make products, we consume it, and we dispose of it, and this model is creating a lot of issues… we have so much waste we don't know what to do with it.” — Lou Tamaehu-Plovier, Circular Talent

Alarming Waste Statistics: A Snapshot of Global Overconsumption

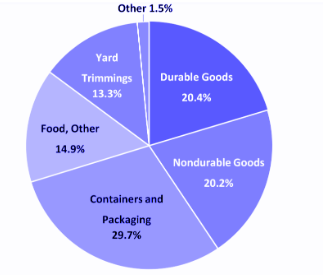

In high-income countries, households buy more and keep products for less time. In the U.S., durable goods like appliances and furniture account for 20% of municipal waste, non-durable goods like clothing another 20%, packaging 30%, and food waste 15%. Nearly 40% of all food before consumption. Compared to 15 years ago, the average consumer buys 60% more clothing items, and keeps it for half as long. Textile waste costs the global economy $500bn annually, while e-waste has reached 62 billion kilograms a year. In 2018, the U.S. EPA estimated that 80% of durable goods, large and small appliances and furniture, end up in landfills. The impact of online shopping is staggering, with an estimated 5bn tons of return items discarded annually. The full cost of convenience is now impossible to ignore.

Decoupling Growth from Waste: The Circular Economy Opportunity

We are not using materials efficiently, and we are rapidly running out of space, ecologically, economically, and physically, to continue business as usual. Yet each waste stream represents an opportunity. As consumer awareness grows, individuals around the world are rethinking their role in driving sustainable consumption. By shifting to a circular economy based on maintenance, reuse, repair, refurbishment, and recycling, brands and policymakers can decouple growth from waste and build systems that are both profitable and sustainable.

The Rise of the Circular Consumer

As a consumer, I try to practice as many circular economy strategies as I can: refuse, reduce, reuse, repair, refurbish, repurpose, and recycle. My commitment to “refuse” is so strong I’ve even argued with checkout clerks who insisted on giving me plastic bags. My sewing kit is always in use to extend the life of my clothes, and most of my trips to the post office involve mailing items to corporate recycling programs.

The Consumer Shift Toward Sustainability

I’m not alone in my frustration with overconsumption and waste. Growing awareness of environmental impacts is driving a cultural shift toward ethical, intentional, and sustainable purchasing. Movements like zerowaste, project pan and no-buy challenges are gaining traction across social media and among influencers. In a 2024 survey on consumption sustainability trends, UK consumers ranked “more considered purchases and buying less” as their top sustainability action.

Gen Z and the Ethics of Consumption

No generation has embraced consumption as an ethical choice more than Gen Z. Around 65% of young consumers research what their purchases are made of, where they are made, how they are made, and by whom. Another 70% seek company and product reviews to verify brand claims before buying. This approach is transforming the consumer landscape, with decisions guided by:

Product materials: Are they sustainably sourced, natural, non-toxic, safe, repairable, recyclable, or compostable?

Packaging: Is it minimal, reusable, recyclable, or compostable?

Producers: Are workers paid fair wages? Are supply chains free of labor violations and child exploitation? Are women treated equitably?

Production methods: Do farms, factories, and transport systems minimize environmental damage and greenhouse gas emissions?

Product quality: Is the product well made, durable, and long-lasting?

As these expectations grow, product designers, manufacturers, and retailers must adapt. To stay competitive and relevant with the next generation of consumers, they must evolve and make bolder commitments to environmental, social, and governance (ESG) goals.

Today, many brands use one or more of over 300+ global certifications to validate the sustainability of their products and operations. Increasingly, brands are moving toward circular business models, incorporating post-consumer and post-industrial recycled materials, shifting to product-as-a-service models like rental and subscription offerings leveraging growing desires for experiences over ownership, and building buy-back and resale channels.

The Value-Action Gap: Bridging Intention and Behavior

While consumer values are shifting, manufacturers remain stuck in a largely linear take-make-waste model. Despite these gains towards more sustainable consumption, many critics and business leaders point to a disconnect between intention and action. Surveys have found that while 65% of consumers say they intend to buy sustainable or purpose-driven products, only 26% follow through. This “value-action gap” stems from price, access, and the difficulty of changing behavior.

Despite this, consumer trends show momentum towards growing markets for sustainable consumption. The global secondhand apparel market grew by 18% in 2023. As of early 2025, resale accounts for 8% of products sold by apparel brands and retailers. Facebook Marketplace now outpaces Amazon’s customer base for certain product categories.

Some brands still hesitate, viewing the value-action gap as a barrier. Others are actively working to reduce it by designing affordable, accessible, and authentically circular products that meet shifting consumer demands and enable brands to engage customers in new and different ways. These brands stand to earn trust, loyalty, and long-term market share.

While a growing number of brands are responding to consumer motivations to buy better and waste less, one strategy remains vastly underused yet powerful: embracing repair as a central pillar of circularity.

Repair Over Replace: The Unsung Sustainability Hero

Discussions of sustainability in consumer products often focus on materials, packaging, and recyclability. Yet the most sustainable choice is to reduce consumption altogether and extend the life of what you already own.

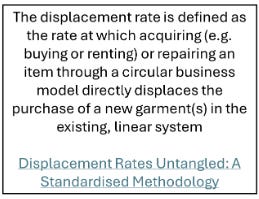

Repair as the Most Impactful Circular Business Model

Among circular strategies, repair has the largest impact on resource efficiency. A 2024 WRAP report found that garment repair services displaced 82% of new purchases, outperforming peer-to-peer garment resale (64.4%), garment rental (48%), and subscription models (42%).

Despite its potential, repair opportunities are scarce in high-consumption economies. When products break, consumers often find repair options limited or unavailable.

Why Repair Is So Hard Today

Growing up in a culture of cheap, fast consumption, when an item breaks or is damaged, our instinct is to toss it, recycling if possible, but more often simply trashing it.. Repair rarely seems viable, partly due to our own declining repair skills, limited access to repair services, and retail systems built to encourage replacement over repair.

Our system remains stuck in a cycle where the cheapest, fastest, and most convenient choice is rarely the most sustainable. Products are priced too low to justify repair, designed for disposability, and sold through retail models that prioritize speed over longevity, making it easier to replace than repair, even when consumers want to fix something they already own.

Real Life Examples: What I Could—and Couldn’t—Repair

Over the past few months, I’ve had several items break. Some were repairable through a brand or local repair shop; others were not:

Sneakers (Veja): After 2 years of wear, the seams and soles were repaired in-store for half the cost of a new pair.

Leather boots (Italy): After 10 years, worn soles were resoled by a local cobbler for half the price of new boots, and no international shippingWristwatch (Swatch): After 1 month, a broken clasp was fixed under warranty. Swatch mailed me a replacement part and instructions free of charge.

Desk lamp (Target): After 8 years, a frayed electrical cord couldn’t be replaced easily or affordably.

Suitcase (Samsung): After 5 years, a broken zipper proved too difficult and expensive to repair.

The barriers to repair remain high due to product design and business models. However, the momentum is shifting. Increasingly, policymakers are stepping in to require manufacturers to prioritize durability and repairability.

The Regulatory Shift Toward Circularity

Most products today are designed for single use, breakdown quickly and cannot be easily repaired, reused, or recycled. Growing legislation around Extended Producer Responsibility (EPR) aims to break this linear take-make-waste model.

How Lawmakers Are Requiring Design for Repair

EPR shifts responsibility to manufacturers to design products with environmentally responsible end-of-life options. Since up to 80% of a product’s environmental impact is determined during design, these policies require companies to use materials and design features that enable durability, repair and recyclability to minimize waste and reduce landfill volumes. EPR promotes a shift from linear business models to circular ones, decoupling profit from the continuous production of new items.

US Extended Producer Responsibility Laws

In the United States, there are currently 141 laws covering 20 product categories across 30 states, affecting 265 million people. Historically, U.S. EPR policies have focused on electronics, mercury thermostats, batteries, pharmaceuticals, paint, fluorescent lighting, and mattresses. EPR legislation is growing across the country: between 2020 and 2024, 76 new EPR laws were introduced, many targeting packaging. Additional product categories under consideration include solar panels, lithium-ion batteries, carpet, gas cylinders, and textiles.

Europe’s Circular Economy Action Plan and Right to Repair

In Europe, the Circular Economy Action Plan (CEAP) was passed in 2020 as part of the European Green Deal, followed by the Ecodesign for Sustainable Products Regulation in 2024. These measures position the EU as a global leader in circularity. They aim to improve product durability, reusability, upgradability, and reparability, giving consumers access to safe, efficient, affordable products designed for repair and high-quality recycling.

The CEAP sets ambitious 2030 targets:

All Products: Reusable, long-lasting, and easy to disassemble and repair

Electronics: Designed for energy efficiency, durability, reparability, upgradability, reuse, and recycling

Textiles: Durable, recyclable, and largely made from recycled fibers; free of hazardous substances; produced with respect for social and environmental standards

Furniture: Built for durability, modularity, and from eco-friendly materials

Built Assets: Improved durability and adaptability; buildings to have digital logbooks

Europe also introduced the Right-to-Repair (R2R) directive to further reduce consumer and environmental costs. The directive mandates that manufacturers offer repair first options, at a cost lower than replacement, even after warranties expire. It also requires clear information for consumers at purchase, including product lifespan, repair service availability, spare parts, and repair manuals.

“The R2R directive signals not just a shift toward a circular economy but a fundamental change in societal values, fostering appreciation for resource conservation and responsible consumption.”

— Circle Economy

While Europe and the U.S. are mandating repair through legislation, I’ve seen equally valuable lessons from everyday markets around the world, where repair and reuse have long been part of daily life out of necessity.

Around the World and Back Again: What Global Markets Taught Me About Repair

Catching up with legislation takes time, especially when entire economic systems must be reoriented. But rising inflation, tariffs, and trade wars are already forcing consumers in middle- and high-income countries to rethink what, when, and how much they buy.

How Low-Resource Markets Embrace Repair Culture

In my work across countries where finances and resources are scarce, I’ve seen firsthand that almost everything can be reused, repaired, or refurbished. In many low-resource markets, items are collected, resold, repurposed, or repaired, leaving little to waste.

One of my favorite parts of visiting local markets is walking through the repair section, where electricians, mechanics, tailors, cobblers, carpenters, and jewelers restore nearly anything brought to them. I’ve even brought damaged clothes, shoes, and jewelry with me on international work trips because repair services are often far more accessible and affordable outside the U.S.

Can Inflation and Tariffs Push Repair Behaviors in the Global North

Since the COVID-19 pandemic, consumer prices have remained well above pre-pandemic levels, profoundly affecting purchasing behavior. A 2024 UK study found that one in three consumers cite inflation as the biggest influence on their buying habits for the coming year.

In the U.S., recent government tariffs on key trading partners have raised prices on everyday goods like clothing, electronics, and pharmaceuticals, as well as big-ticket items like cars. Economists estimate even a modest 2% price increase could reduce purchasing power for U.S. households by $2,700–$3,400 annually.

As costs rise, consumers are being pushed to make more deliberate purchasing choices, trading up or down based on perceived value, favoring products that are durable, maintainable, and capable of being reused or repaired.

These real-world insights offer valuable insights for brands: repair isn’t just a regulatory mandate or cultural tradition, it’s an emerging business opportunity that can build loyalty and long-term value.

Beyond the Sale: How Repair-as-a-Service Can Boost Business

In the coming years, legislation, consumer values, and rising costs will converge to create a booming market for repair services. For forward-thinking brands and strategy leaders, repair offers a strategic advantage and a new path for business growth.

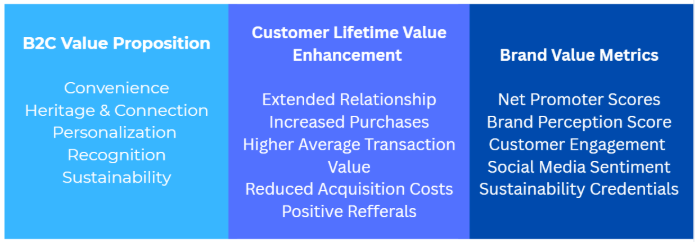

Repair services can extend the customer lifecycle, differentiate product offerings, unlock new revenue streams, and reinforce a brand’s commitment to environmental, social, and governance (ESG) goals. For companies looking to increase profitability and customer loyalty, repair delivers tangible results.

“Repair services are a powerful and authentic way to engage with customers—and to build a brand’s respect and trust.”

— Emily Watts, Coblr

Product and service quality remain leading factors in the development of customer loyalty. Offering repair services allows brands to maintain high-touch customer care well beyond the point of sale, creating memorable experiences that foster loyalty and repeat business.

Repair provides a triple win:

For customers: Extended product life and greater value from existing purchases

For businesses: Increased revenue through additional services and higher average transaction value

For the environment: Reduced emissions and less waste

Repair Business Models in Action

Multiple repair business models exist to help brands increase revenue, strengthen customer relationships, and enhance brand differentiation and loyalty.

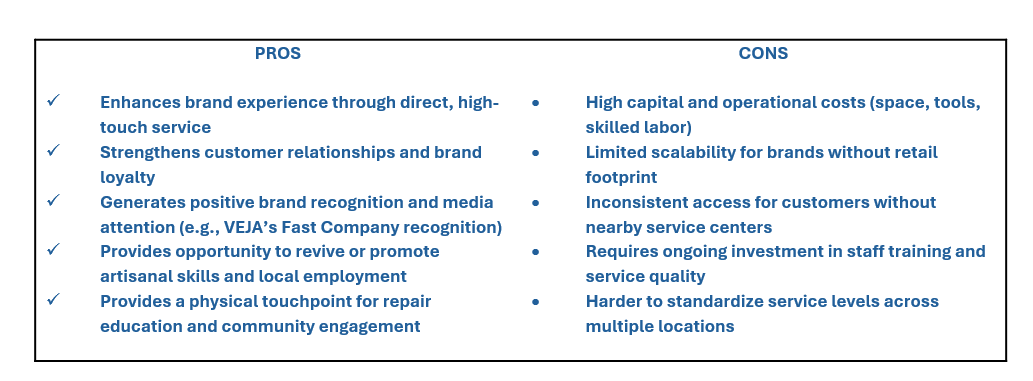

Business Model 1: On-Site Repair & In-House Craft

Brands interested in repair and cleaning services can build in-house models to deliver these offerings directly to customers.

VEJA, the sustainable shoe brand, launched its Clean Repair Collect initiative in 2020 to reduce shoe waste and revive the craft of cobbling. Starting in Bordeaux, the program has expanded to Paris, Berlin, Madrid, and Brooklyn, offering in-store repairs that extend product life and strengthen customer relationships. To date, over 27,000 pairs have been repaired, helping VEJA turn post-sale service into both a revenue stream and a brand loyalty driver. The initiative earned VEJA a spot on Fast Company’s most innovative fashion and apparel companies of 2025.

Buying any Apple product isn't cheap, but Apple has set a gold standard for brand loyalty through seamless, premium post-sale support. AppleCare and AppleCare+ set an early benchmark for repair servicing through a comprehensive suite of post sale support services. Across devices, customers benefit from extended warranties, 24/7 technical support, and multiple repair options—ranging from in-store service to mail-in and DIY repairs. This integrated service ecosystem enhances product value, strengthens brand loyalty, and generates steady recurring revenue.

On-site repair and in-house craft models are best suited for brands with physical retail locations, high-value products, and a commitment to service excellence. VEJA and Apple have shown how this approach can extend product life, increase revenue, and cultivate long-term customer relationships. However, these models carry significant operational costs, have limited scalability, and require consistent quality standards across all locations.

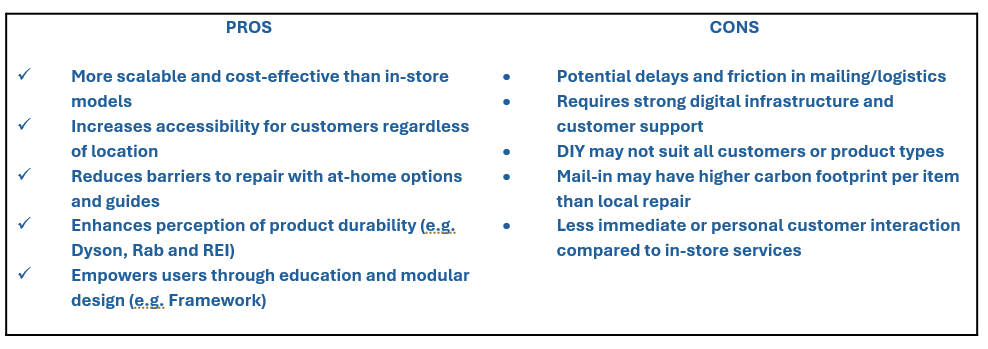

Business Model 2: Mail-In and DIY Repair Models

For many companies, opening physical repair centers is impractical due to the high costs of space, equipment, and staff across multiple locations. An alternative is mail-in repair: customers send their products for repair, or the company provides replacement parts and instructions for at-home fixes.

Companies like MyTurn, Thingery, Circular Library Network (CLN) are expanding access to DIY repair by partnering with libraries, schools, municipalities, and community groups to systematize tool libraries and at-home repair resources.

Rab, an outdoor gear brand, runs a mail-in Service Centre offering repairs, cleaning, and spare parts. In 2021 alone, it completed over 17,500 repairs, reinforcing its ethos of “repair over replace.” The service begins with an online request and quote, after which customers mail in their items for restoration. According to Rab, 66% of repairs completed in 2021 directly displaced the need for a new purchase—extending product life and reducing environmental impact. By integrating repair into its core brand promise, Rab deepens customer trust and strengthens its reputation for durable gear.

Dyson offers both in-store and mail-in repair services, helping customers troubleshoot issues and access replacement parts under or out of warranty. Customers receive step-by-step support and mailed parts for DIY fixes or can opt to send in products for repair. In 2023, Dyson reported that 80% of eligible vacuum repairs were resolved without product replacement, significantly reducing returns and landfill waste. This hybrid model lowers barriers to repair while reinforcing Dyson’s reputation for engineering durable, high-performing products.

REI’s Care and Repair platform provides expert guides and links to DIY and professional repair services, empowering customers to extend the life of their outdoor gear and reduce waste. The site covers gear maintenance across activities like hiking, cycling, and snowsports. REI estimates that in 2023 its repair and maintenance services helped extend the lifespan of products like bikes, skis, and snowboards for over 300,000 customers. By embedding repair into its customer experience, REI drives long-term loyalty while advancing its environmental goals.

Framework offers modular laptops designed for easy repair, customization, and longevity. With just one screwdriver, customers can swap out ports, memory, storage, and even graphics cards, extending product life and reducing e-waste. Framework aligns with right-to-repair values and offers a practical, scalable model for circularity in the tech hardware industry where durability, modularity, and user agency are prioritized from the start.

Mail-in and DIY repair models provide a scalable, lower-cost alternative to in-store services. They eliminate the need for physical infrastructure while increasing access for customers across geographies. Brands like Rab, Dyson, REI, and Framework have demonstrated the model’s potential to reduce waste, extend product life, and build durable brand reputations. However, these models also come with trade-offs: they require strong digital infrastructure and customer support, may introduce shipping delays, and lack the personal experience of in-store repairs. DIY repairs may not suit every product or customer, and mail-in repair can carry a higher carbon footprint per item compared to local repair options.

Business Model 3: Team Up to Fix Up

For many companies—especially smaller ones—investing in a dedicated repair service isn’t feasible. Fortunately, the rise of service partnerships offers an attractive alternative. These specialized companies, often focused on fashion and apparel, provide repair, cleaning, and reverse logistics support for brands seeking to offer repair services to their customers.

Alternew, founded in 2019 in New York, provides tailored alteration and repair services through a platform that connects brands, retail staff, customers, and tailors. In-store pilots with brands like Reiss have included fittings and on-site alterations, improving customer satisfaction while reducing returns and waste. Additional partners include Everlane, Faherty, and Moose Knuckles.

Founded in 2022, United Repair Centre (URC) is a UK-based repair service company that partners with fashion brands to offer high-quality garment repairs, integrating logistics, customer engagement, and impact reporting into brand operations. Since launch, it has repaired over 30,000 garments and saved 12 tonnes of textiles from landfill, supporting partners like Patagonia, GoreTex, and Lululemon in meeting sustainability goals and building post-sale customer loyalty.

Coblrshop, launched in 2023, offers mail-in repair for footwear and leather goods, matching customers with skilled cobblers through a streamlined digital platform. In 2024, it introduced Coblr, a SaaS solution for repair artisans, to improve repair shop operations and order management. With brand partners like Coclico, Bryr, and Ally Shoes, Coblrshop supports both circular fashion and artisan livelihoods, while improving customer experience and promoting brand loyalty. Coblr also has a repair finder feature on their website, empowering consumers to identify close repair options.

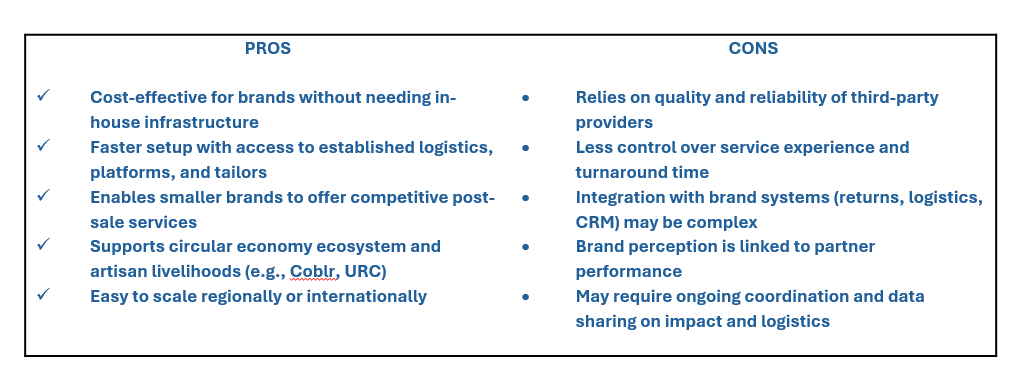

Partnering with third-party repair providers is an ideal strategy for smaller or resource-constrained brands that want to offer repair services without building internal infrastructure. Companies like Alternew, URC, and Coblr provide scalable platforms connecting brands, customers, and skilled artisans. These partnerships help brands meet customer expectations, reduce waste, and enhance post-sale engagement while supporting circular fashion and local economies. However, outsourcing repair services introduces challenges: maintaining quality across partners, integrating systems, and managing a customer experience that remains consistent. Success depends on strong coordination, clear data sharing, and strategic alignment between the brand and its repair partners.

So how can companies interested in repair move from concept to action? The next section offers a practical framework to help brands strategically plan, pilot, and scale repair as part of their core business model.

A Practical Framework for Brands: Mapping Your Repair Journey

When working with business owners and entrepreneurs globally, I often rely on simple tools like the lean business canvas and customer journey mapping to help define and visualize business goals. These same tools can guide brands exploring how to integrate repair services into their core offerings.

Here are practical steps for brands considering a repair strategy:

Ten Steps to Build a Repair Service Strategy

Step 1 - Identify the Problem:

Start by clearly defining the problem your repair service will solve. Many products are not designed for easy repair, leading to unnecessary waste, lower customer satisfaction, and missed opportunities for deeper engagement and recurring revenue.

As consumer demand shifts toward sustainable, durable products, repairability is becoming more than a brand differentiator, it’s a business imperative.

Step 2 - Map Customer Segments:

Brands must understand which customer groups they aim to serve. Are they:

Existing customers seeking to extend the life of a valued product?

Lapsed customers who could be re-engaged through new service offerings?

New customers drawn to repairability, strong customer service, or a brand’s investment in circular business practices?

Identifying these segments will help tailor repair services to meet specific needs and expectations.

Step 3 - Define the Value Proposition:

For repair services to succeed, brands must offer a compelling reason for customers to engage.

Position repair as a premium, sustainable service that extends product life and strengthens customer relationships. A well-defined value proposition can build customer loyalty, reinforce ESG commitments, and create new revenue streams.

Step 4 - Outline the Solution:

Brands must develop a clear roadmap for how their repair service will operate:

Assess whether products are modular, durable, and designed for part replacement.

Determine if repairs can be handled in-house, via mail-in service, or through external partnerships.

Once a model is chosen, invest in infrastructure: integrate repair into customer support, provide clear repair instructions, and create tracking systems to keep customers informed of repair status.

The type of repair service offerings will vary by product complexity and brand capabilities:

Standard repairs (quick turnaround): screen replacements, shoe heel replacements, basic clothing alterations, cleaning

Complex repairs (intermediate timelines): garment relining, leather restoration, watch servicing, color restoration

Bespoke services (extended timelines): custom part replacement, redesign, vintage restoration, full rebuilds

Step 5 - Map Channels:

Brands must identify the right channels to deliver repair services. Options include in-store repairs, mail-in programs, at-home services, and digital platforms that manage logistics and customer communication.

Robust digital tools like CRM and e-commerce systems are essential for coordinating repair workflows, tracking inventory of replacement parts, and maintaining customer engagement throughout the repair process.

Step 6 Determine the Revenue Model:

Brands should define how they will monetize repair services. Depending on the chosen solution, revenue models may include:

Charging for individual repairs

Bundling repair and warranty fees

Offering repair subscriptions

Using repairs as a customer touchpoint to upsell and boost lifetime value

Well-executed repair services can also enhance brand reputation, allowing brands to command a premium from value-driven consumers.

Step 7 - Assess the Costs:

Integrating repair services into an existing company will require upfront investment. Costs may include product design modifications, hiring or training skilled repair staff, purchasing CRM software, building logistics networks or partnerships, and marketing the repair program.

Step 8 - Define Key Metrics:

To measure success and guide improvement, brands should track key performance indicators such as:

Repair volume

Repair turnaround time

Customer satisfaction scores

Repeat engagement rates

Average transaction value

Brand perception scores

Environmental impact (e.g., GHG reduction from waste diversion)

Launching a pilot program allows brands to test services, collect data, and refine operations before expanding.

Step 9 - Determine the Unfair Advantage

Repair services can offer a meaningful edge over competitors. Brands that design products with repairability in mind and deliver seamless customer care can stand out, building stronger customer loyalty and long-term differentiation in the market.

Step 10: Envision the Customer Journey

When piloting a repair service, brands must consider every stage of the customer repair journey:

Awareness of the repair offering

Easy assessment of repair eligibility

Simple and accessible service channels

Positive interactions with the repair team

Re-engagement once the repaired item is returned

Each touchpoint can make or break customer perception of repair services. Brands should start small, test thoroughly, and iterate to ensure consistency and quality throughout the repair journey.

Building a repair program is only part of the solution. Brands must also motivate customers to choose repair by eliminating barriers, reinforcing new habits, and clearly communicating the the value and benefits of repair

Nudging Consumers Toward a Repair-First Mindset

While policies, pricing, and changing consumer values are guiding us toward sustainability, brands play a critical role in making repair a default option for customers.

Marketing Repair: Emotional + Rational Appeals

Behavioral economics offers effective tools to encourage repair behavior:

Loss aversion: People experience more discomfort from losing something they already own than satisfaction from acquiring something new.

Endowment effect: Consumers develop emotional attachments to their belongings. Messaging like “It’s no longer just clothing, it's a memory brought back to life” can tap into this sentiment.

Social proof: Sharing relatable data can influence behavior. For example: “60% of REI customers chose to repair their tent rather than buy a new one—extending its life and saving money for other camping essentials.”

Using these strategies, brands can normalize repair behavior and foster long-term customer engagement.

Brand marketing should combine emotional and rational appeals: helping customers save money, preserve beloved items, contribute to climate action, or find satisfaction in DIY repair. The most effective campaigns promote self-efficacy by showing that repair is both accessible and meaningful.

As costs rise and budgets tighten, brands should frame repair as a smart financial decision. Highlight how frequent replacement purchases add up over time, and position repair and durable products as ways for consumers to save money while reducing waste.

Incentives and Social Proof to Drive Repair Behavior

Public commitments, like repair badges, or in-store competitions for most repairs completed can help establish new social norms. Habit formation is equally critical: prompts and reminders (e.g., warranty expiration alerts, maintenance notifications, and clear service updates) encourage consumers to shift from passive ownership to active product care.

Financial incentives such as discounts on repair services, replacement parts, or partner service credits can further motivate customers to explore repair options.

As consumer expectations, policy mandates, and business incentives converge, the companies that act now will be best positioned to lead in the emerging repair economy.

The Opportunity for Brands to Lead the Next Wave of Circularity

The shift toward a circular economy is no longer a distant trend, it’s happening now, driven by rising consumer expectations, evolving legislation, economic pressures, and increased business competition. If you’re ready to turn sustainability goals into business results and lead in circularity, here’s how to begin:

Assess Product Repairability

Audit your product lines and supply chains to identify where modular design, durable materials, or repair services can extend product life.

Ask: Are our products designed to be easily repaired, upgraded, or refurbished, or are they built for disposal?

Choose Your Repair Strategy

Determine the right repair model for your business:

In-house repair program

Mail-in or DIY repair service

Partnerships with external repair providers

Ask: What repair service model fits best with the brand, customers, and operational capacity?

Engage Customers and Track Impact

Design customer journeys that normalize repair. Offer incentives, make repair convenient, and celebrate sustainability milestones.

Track key metrics: number of repairs completed, customer satisfaction, emissions saved, and profit generated.

Ask yourself: How easy is it today for customers of a brand to repair instead of replace and how is impact being measured?

Brands that embrace repair today will lead tomorrow’s markets, earning customer loyalty, unlocking new revenue streams, and future-proofing their operations.

Ready to start? Let’s chat.

Thanks for reading! Know someone working on repair? Share this with them.

For more: Community | Accelerator | Open Climate Firesides | Deep Dives