How Climate Insurance works

A behind-the-scenes look at how parametric tools like RapidShield are transforming humanitarian response, rethinking risk finance, and building resilience for millions

Welcome to Climate Drift - the place where we dive into climate solutions and help you find your role in the race to net zero.

If you haven’t subscribed, join here:

Hey there! 👋

Skander here.

The global insurance system is cracking under climate pressure and refugees are on the frontlines of the fallout.

In today’s deep dive, Driftie Mojisola Terry, Disaster Insurance lead at the UNHCR, walks us through a solution that is already redefining humanitarian finance: parametric insurance. Moji has helped design and deploy these rapid-payout policies across five African countries, proving that you can get cash to households before floodwaters rise or crops fail.

Moji unpacks how tools like RapidShield are shifting humanitarian response from reactive to proactive, why the dismantling of US foreign aid threatens more than budgets, and what’s at stake when climate justice gets lost in translation.

Whether you’re in government, insurance, philanthropy, or just wondering what climate insurance looks like, this is a grounded blueprint for action.

🌊 Let’s dive in!

But first, who is Moji?

Mojisola Terry is a seasoned strategist with deep expertise at the intersection of climate risk, humanitarian aid, and innovative finance. Throughout her career dedicated to designing and implementing scalable climate resilience solutions, she has collaborated extensively with leading organizations such as ARC Ltd and Humanity Insured to develop pioneering insurance products that protect vulnerable populations across Africa from climate shocks.

Her work reflects a commitment to transforming humanitarian response through strategic risk transfer, ensuring that displaced communities receive timely and dignified support. Moji's approach blends rigorous data-driven product design with a deep understanding of operational realities on the ground. As she leads the Climate Drift Challenge, she brings a vision for climate justice and resilience that centers the needs of the world's most vulnerable, advancing innovative finance solutions that deliver impact where it's needed most.

🚀 Want to make an impact?

Our next accelerator cohort kicks off soon, and applications are still open, though spots are limited. If you’re ready to drive climate impact, now’s the time to apply:

How Climate Insurance works

This is a long deep dive. Click on the headline to read it in full 👆

A behind-the-scenes look at how parametric tools like RapidShield are transforming humanitarian response, rethinking risk finance, and building resilience for millions

The Human Face of Climate Resilience Programs

When I read about US foreign aid cuts, I see only abstract figures and diplomatic fallout—numbers that frustrate me because they mask the human beings caught in the crosshairs. The true impact isn't measured in dollars lost but in lives upended.

I never imagined my career would lead me to obsess over weather patterns and insurance policies. "Parametric insurance? Is that the paranormal kind?" I'd joke. When I joined UNHCR as a risk advisor in Southern Africa 5 years ago, I expected to focus on aid diversion and corruption. Instead, climate change crashed like a giant meteor and scorched what I knew was the previous version of the earth.

For refugees in climate-vulnerable countries, funding cuts aren't budget line items—they're the difference between resilience and ruin. Climate change isn't just another risk factor—it's the mother of all vulnerability multipliers. Families watch inconsistent rainfall destroy their gardens, their lifeline. Children leave school because survival takes priority. Parents skip meals so their kids can eat.

What remain frustrating to me is how slowly systems respond—we're using 20th century tools for a 21st century catastrophe. That realization sparked my journey to pioneer climate risk insurance for refugee populations. I'm constantly reminding decision makers, policy advisors and donors that behind every data point is a person whose story rarely makes headlines. Refugees aren't numbers—they're teachers, farmers, doctors with dreams that didn't include displacement.

As recently reported in *The Guardian*, the dismantling of USAID will have a "huge impact on global climate finance," with data showing significant funding gaps for climate adaptation programs worldwide. Yet these reports rarely center on the people most affected—the faces and stories behind the statistics remain largely untold.

The true impact isn't measured in dollars lost but in lives upended.

For the 70% of conflict-displaced people residing in highly climate-vulnerable countries (Chad, Bangladesh, Uganda, Pakistan, and Ethiopia are the top 5 most climate-vulnerable countries hosting the highest number of refugees), US funding cuts aren't simply line items in a budget. They represent the difference between resilience and ruin. Refugees already face climate risks three times higher than general populations—a vulnerability gap that's now set to widen dramatically.

As climate degradation accelerates, forcing unprecedented waves of migration and displacement, we stand at the threshold of profound global change.

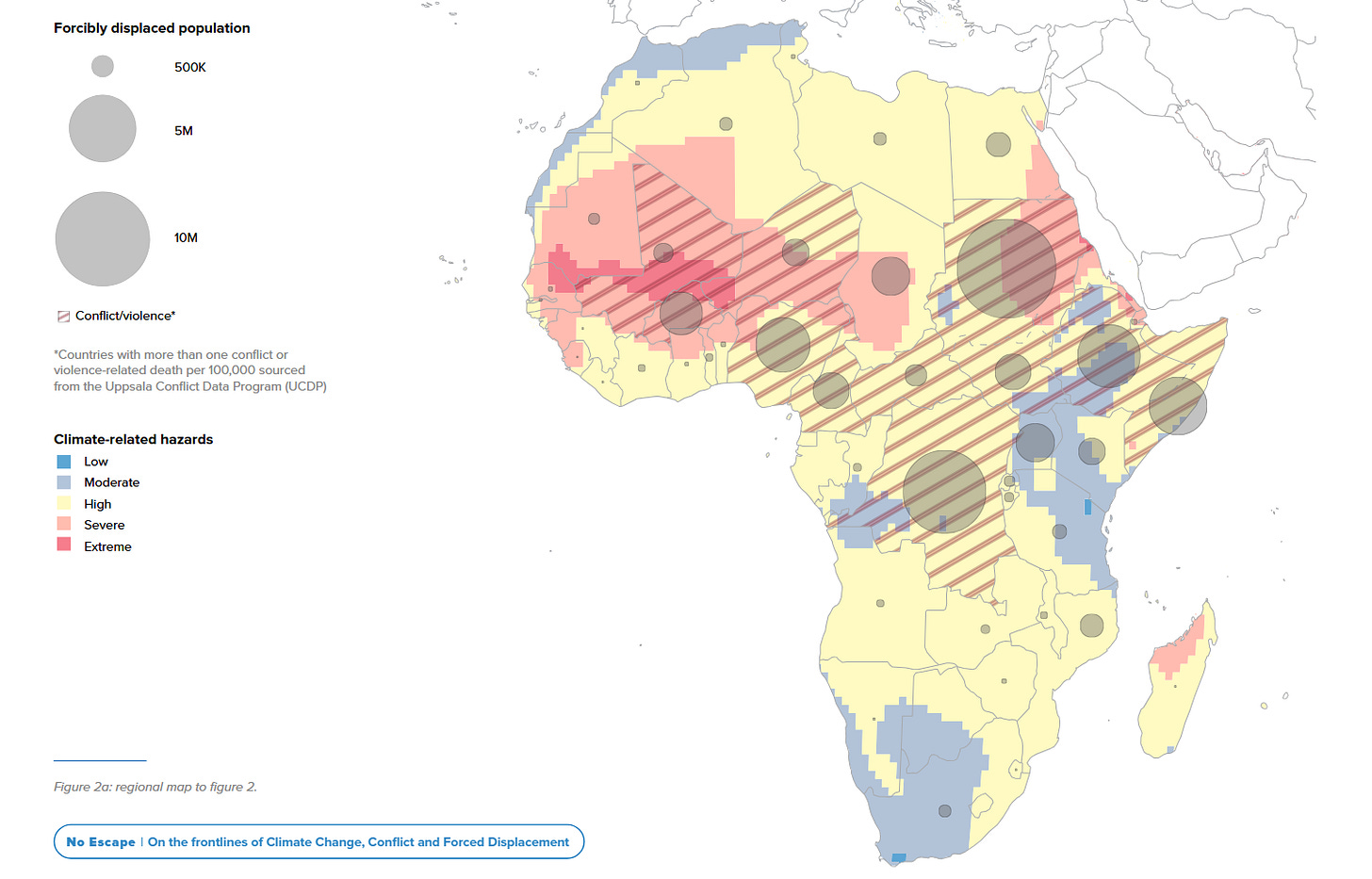

Looking at these visualizations from the UNHCR report No Escape | On the frontlines of Climate Change, Conflict and Forced Displacement, the data reveals a clear pattern: the pink striped regions represent critical hotspots where severe climate hazards coincide with conflict zones, creating conditions for large-scale displacement. These hotspots are not randomly distributed but concentrated predominantly in the Global South. Examining the African continent specifically, we observe that even regions without active conflict face high climate risk. This geographic distribution demonstrates that communities who have historically contributed minimal greenhouse gas emissions are now positioned to experience the most severe climate impacts, potentially forcing millions to leave their homes as environmental conditions deteriorate beyond habitability. The evidence presented in these maps objectively illustrates the disproportionate burden of climate change and its implications for human mobility across regions.

While the situation of refugees and displaced people in climate vulnerable settings is dire and the solutions seem daunting and in some cases insurmountable, the optimal solutions that are practical involve investing in solutions where these refugees are currently, and ensuring that they are able to become self-reliant. This requires mechanisms that provide relief and mitigate risk and then can be used to bridge towards sustainability, resilience and adaptation.

By developing anticipatory frameworks that address needs where people are rather than waiting for large-scale displacement, we can transform our approach from reactive to proactive. This shift not only respects people's desire to remain connected to their homes and communities when possible, but also builds capacity that serves both immediate humanitarian needs and longer-term development goals.

Perhaps a (fictional) story from the frontlines would help paint a clearer picture…..

Amina reaches for her mobile phone as storm clouds gather over her refugee settlement in northern Uganda. The early warning SMS arrives with precision: heavy rainfall is expected in six hours, and potential flash flooding in low-lying areas. With this advance notice, she alerts her neighbors, moves essential belongings to higher ground, secures her small vegetable garden with protective barriers, and ensures her children's school documents are safely stored in waterproof containers.

When the rains come, they are intense but manageable. The settlement's improved drainage systems—installed after climate vulnerability mapping identified this area as high-risk—channel most floodwaters away from homes. For damages that do occur, Amina knows pre-arranged financing mechanisms will activate within days, triggered automatically by rainfall measurements exceeding the predetermined threshold.

This isn't a fantasy or a nice-to-have scenario—it's what effective climate resilience programs make possible for displaced and vulnerable communities living in climate-vulnerable settings. And it's precisely what is at risk as one of the major global powers rejects and retreats significantly from commitments and obligations to address the climate crisis.

The Hidden Losses: Knowledge, Innovation, and Self-Determination

On January 24th, 2025, the US Government implemented dramatic changes to its foreign aid and development infrastructure, announcing sweeping cuts, pauses, and in some cases, complete dismantling of programs. The consequences have sent shockwaves through humanitarian, development, and health sectors globally, creating significant disruption that continues to unfold. While the immediate impacts made headlines, beneath the surface lies a more complex story of erosion. These policy shifts threaten to unravel decades of progress in ways that may not be immediately visible but will be profoundly felt by communities worldwide.

"What's being lost isn't just money," explains a contractor from Winrock International who worked on agricultural projects in Nepal until recently. "It's the intellectual and technical space to drive meaningful change." In 2021, her agricultural development team faced a crisis when floods threatened their output targets. Rather than scrambling to meet arbitrary numbers, they made a conscious decision to use the moment as leverage—to show USAID leaders why climate resilience needed to be central to all agricultural programming.

"We turned a potential failure into an opportunity to secure investment in early warning systems and climate-adaptive storage facilities," she recalls. "That kind of nuanced, context-specific innovation happens when there's funding stability and trust between partners."

This is the untold story of the dismantling of the US foreign assistance structure: the loss of thousands of purposeful, probing conversations where climate solutions were being reimagined from the ground up. Where local knowledge met technical expertise. Where refugees and vulnerable communities weren't just aid recipients but active partners in designing their resilience strategies.

Widening Impact Beyond US Foreign Assistance

The impact also extends to multilateral funding pools supporting climate initiatives, migration, and displacement through the UN and other cooperation platforms. "We stand to lose more than money," the Director of Violence Prevention of IRC notes, "we stand to lose the catalytic spaces, experimentation, incentives, and drive to challenge the status quo."

Immediate-Term vs Long-Term Programming: A Critical Distinction

In responding to climate crises, especially in fragile contexts like northern Uganda, we must be clear-eyed about the difference between immediate-term and long-term interventions—and why both are indispensable.

Immediate-term responses such as food and cash distributions provide critical lifelines. They address urgent needs when droughts, floods, or storms strike, preventing starvation and stabilizing families like Amina’s. These interventions are lifesaving but inherently reactive and temporary.

Long-term programming focuses on systemic resilience. This includes:

Climate risk mapping to identify vulnerable zones before disaster strikes.

Early warning systems (EWS) that give communities precious time to prepare, as Amina experienced.

Resilience building, which means investing in sustainable livelihoods, climate-smart agriculture, and community empowerment to reduce vulnerability over time.

This layered approach ensures that while immediate survival is secured, communities are not trapped in a cycle of repeated crises but are empowered to withstand future shocks.

The distinction between climate solutions developed under stability versus resource constraints reveals fundamentally different approaches. With the current funding cuts, responses will increasingly focus on immediate needs—addressing symptoms rather than underlying vulnerabilities.

"When funding is stable and partnerships are built on trust, we can develop solutions that address root causes and build genuine capacity," notes the contractor from Winrock. "With constrained resources, the focus inevitably shifts to short-term interventions that may not contribute to long-term resilience."

Climate Justice and Economic Models

"I am not worried only about the funding gap," reflects the Director of Violence Prevention at IRC. "I am worried about the status quo on critical thinking, coupled with leverage, capacity, and clout."

Without influential actors who can engage with different economic growth models, including those ideologically opposed to climate justice frameworks, the focus may shift entirely to sustainability and efficiency within capitalist models rather than addressing deeper systemic issues.

"Climate Justice is no longer a compelling framing to engage the US and other powerhouses in shifting the status quo," the Director observes. "Climate resilience and framing our work in terms of sustainability, efficiency, and contribution to a capitalist model of economic growth is the elephant in the room I think we are not ready to look at."

Moving Forward

The situation creates urgent questions about who will fill these critical gaps in climate-responsive programming for refugee and forcibly displaced communities. Will other bilateral donors, multilateral institutions, private sector entities, or philanthropic organizations step forward? And will they provide not just funding but the intellectual space for innovation and community partnership that made USAID's approach valuable?

What seems clear is that without intentional intervention, the most climate-vulnerable displaced populations will face increasing challenges with fewer resources and less support for developing their resilience strategies. The private sector and philanthropy may occupy advocacy spaces, but as the Director of Violence Prevention for IRC notes, "There are few actors in the bilateral space who afforded the space to implement and test vertically (standalone) but also to look at ways to meaningfully mainstream climate justice, climate finance, DRF, etc. into development work."

For refugees like Amina, the stakes couldn't be higher. These aren't abstract policy debates but decisions that will determine whether they can continue to face climate disasters with dignity and resilience, or whether they will be left increasingly vulnerable in a warming world.

Parametric Insurance: A Game-Changer in Climate Finance

Parametric insurance is a form of pre-arranged financing that triggers automatic payouts when predefined climate thresholds—like wind speed during a cyclone or rainfall levels during a drought—are met. Unlike traditional insurance, which requires lengthy damage assessments, parametric insurance delivers funds swiftly, enabling rapid response.

For instance, in northern Uganda, if rainfall exceeds a certain level signaling flood risk, funds are immediately disbursed to support affected communities. This mechanism reduces delays, cuts bureaucratic red tape, and ensures that families like Amina’s can recover faster and with dignity.

Parametric insurance is not just a financial tool; it is a promising alternative to traditional humanitarian aid, shifting the paradigm from reactive relief to proactive resilience. It also directly addresses climate justice by providing compensation for loss and damage—the unavoidable harms inflicted by climate change on vulnerable populations who contribute least to the problem.

Pioneering Climate Risk Insurance: A Path Forward

As climate impacts intensify and traditional funding sources become constrained, innovative approaches are emerging to fill critical gaps. One such pioneering initiative is the RapidShield program, a parametric insurance system established through the UNHCR-ARC partnership along with other donors that provides a blueprint for climate resilience among refugee and forcibly displaced populations.

RapidShield: Bridging Relief, Resilience, and Climate Justice

RapidShield embodies this shift. It integrates parametric insurance with resilience-building programs to create a comprehensive response that is timely, efficient, and just.

This approach recognizes that climate crises are not just environmental events but profound justice issues. By linking immediate relief with long-term adaptation, RapidShield helps communities break free from the cycle of vulnerability and builds pathways toward sustainable futures

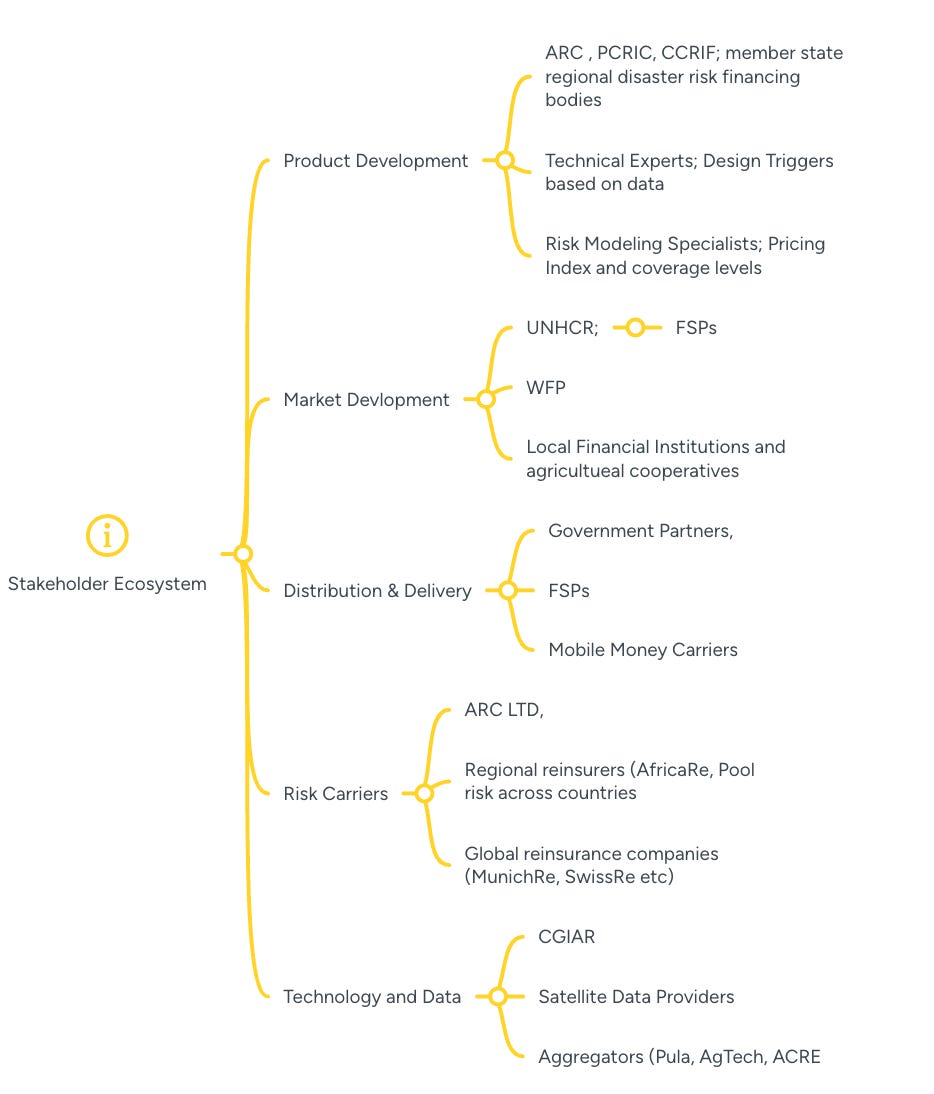

Stakeholder Ecosystem Synergy

This initiative represents a comprehensive model of collaboration across the entire insurance value chain:

The London Marketplace featured the work of RapidShield in a recent podcast.

A Remarkable Growth Trajectory

What began as a single pilot has transformed into a flywheel of expansion and impact:

- Geographic Growth: From 1 country to 5 countries in just 12 months, with active solutions now spanning all three African regions (West, East, and Southern Africa)

- Financial Scale: Premium investments surged from $250,000 to over $3 million in a single year

- Impact Reach: Expanded from protecting 2,600 households (13,000 individuals) in 2023/24 to a projected 60,000 households in the coming seasons

The model aligns with Global Shield Financing Facility priorities and has mobilized resources where traditional funding has receded. In Malawi, the system has already proven effective, with the $400,000 payout triggered by rainfall deficits arriving precisely when families needed to purchase seeds and fertilizer for the new planting season.

The Strategic Imperative: Beyond Humanitarian Action

Addressing climate resilience for refugee populations isn't merely a humanitarian obligation—it's a political and economic necessity with global implications. As climate impacts intensify across sub-Saharan Africa, parts of South America, and Asia, these regions face disproportionate vulnerability to hazards with limited recovery capacity. Without targeted intervention, these conditions will inevitably drive mass migration, regional instability, and cascading economic disruptions that extend well beyond affected regions.

The political reality is stark but often unspoken: investing in climate resilience for vulnerable populations now costs dramatically less than managing forced migration and humanitarian crises later. Yet this pragmatic calculation must be balanced with a fundamentally human-centered approach. People are not simply statistics to be managed or economic assets to be protected—they are individuals with dignity, agency, and the right to build secure livelihoods in their communities.

Programs like RapidShield demonstrate that climate finance can simultaneously address humanitarian needs while supporting regional stability. When refugee households receive timely, predictable financial support following climate shocks, they can:

- Protect essential assets rather than liquidating them at distressed prices

- Maintain their children's education despite hardship

- Invest in recovery and adaptation strategies rather than resorting to dangerous migration

- Continue participating in local economic activity, benefiting host communities

Every dollar invested in proactive climate resilience generates multiple returns: in human potential preserved, in regional stability maintained, and in avoided crisis response costs. This is particularly crucial in regions where traditional funding is retreating, creating a vacuum that—if left unfilled—guarantees greater suffering and instability.

A Call to Action: From Pilots to Sustainable Programs

The convergence of the insurance crisis and refugee protection imperatives demands bold action across sectors. Here’s how stakeholders can drive systemic change:

Philanthropists and Donors:

Prioritize funding for integrated programs that combine short-term aid (food, cash) with investments in early warning systems, climate risk mapping, and resilience building.

Support community-led initiatives in climate-vulnerable refugee and displacement settings, ensuring voices like Amina’s shape solutions.

Prioritize support to host governments and advocate for inclusion of refugees and displaced populations

Insurance Giants (AXA, Hiscox, Munich Re, and others):

Expand parametric insurance products tailored to vulnerable and displaced populations.

Partner with governments and humanitarian actors to develop sustainable loss and damage financing frameworks that uphold climate justice.

Host Governments:

Invest in climate adaptation infrastructure, including early warning systems and intersectional vulnerability and risk mapping (food insecurity, health & climate change) that includes displaced populations.

Facilitate multi-stakeholder collaborations to implement innovative insurance solutions and resilience programs.

Humanitarian Actors (UN Agencies and NGOs):

Ensure meaningful participation of displaced communities in decision-making processes around climate adaptation and disaster risk management.

Amplify their lived experiences to inform policies that are equitable and responsive.

Amina’s story is not just a narrative; it is a mirror reflecting the urgent need for a comprehensive, just, and forward-looking climate response. By combining immediate relief with innovative financial tools like parametric insurance and embedding climate justice at the core, we can transform vulnerability into resilience. This is the future we must build—together, urgently, and with unwavering commitment.

Real-Time Reality Check………..

Before we enthusiastically expand climate insurance in developing regions, we must acknowledge insurers' urgent warnings that climate risks threaten to overwhelm the traditional insurance industry. As firms in the Global North sound alarms about their sustainability, we cannot simply export these vulnerable models to the Global South. Despite these challenges, opportunities exist to design more resilient insurance frameworks that can withstand intensifying climate impacts and create sustainable protection for vulnerable communities when they need it most.

The Risk Managers are Running Out of Options

The accelerating climate insurance crisis presents both a dire warning and a strategic imperative for systemic reform. Recent developments following the devastating LA wildfires underscore how climate risks are destabilizing insurance markets while revealing pathways for transformative action aligned with refugee resilience needs.

The insurance industry is sounding alarms about climate risk—an urgent wake-up call that underscores how deeply intertwined financial systems are with the escalating climate crisis. Recent developments in the United States highlight this growing instability:

- In Florida, average home insurance costs surged by 42% in 2023 due to intensifying hurricane risks, while major insurers are withdrawing entirely from wildfire-prone regions like California.

- The Guardian[1] has reported that entire areas are becoming "uninsurable," mirroring trends seen globally in high-risk regions such as Australia and Mediterranean Europe.

- The podcast A Matter of Degrees [2] recently explored how climate risk is breaking insurance markets, making coverage unaffordable for millions while exposing systemic vulnerabilities.

These trends represent more than just market fluctuations—they are a "canary in the coal mine" for broader economic instability driven by unchecked climate impacts.

Reform Imperatives: Divestment, Litigation, and Adaptation

The insurance crisis reveals three interconnected imperatives for reform that align with broader efforts to protect displaced and vulnerable populations:

1. Divestment from Fossil Fuels

Insurers currently invest over $536 billion globally in fossil fuel projects that exacerbate climate risks. Divesting even a fraction of these funds could unlock critical resources for climate adaptation programs benefiting refugees. For example:

Redirecting just 10% of fossil fuel investments could fully capitalize resilience programs for 50 million displaced people by 2030.

2. Strategic Litigation

Insurers face growing liability for underwriting fossil fuel projects that contribute directly to worsening climate impacts. Legal precedents from lawsuits against oil majors offer a roadmap for holding insurers accountable while incentivizing shifts toward sustainable practices.

3. Mitigation-Adaptation Synergy

Investing in mitigation measures alongside adaptation strategies can reduce insured losses significantly—by up to 25%, according to data from EIOPA (European Insurance and Occupational Pensions Authority). Scaling these approaches within refugee settlements could save billions annually while protecting vulnerable populations from disaster-related displacement.

Closing the Loop: Insurance as a Catalyst for Climate Justice

The insurance industry’s crisis mirrors broader failures in climate finance but also reveals opportunities for transformative action. By divesting from fossil fuels, ramping up investments in mitigation/adaptation measures, and leveraging strategic litigation, insurers can play a pivotal role in protecting displaced populations while stabilizing their own markets.

For refugees like Amina—who rely on timely financial support to recover from disasters—these reforms aren’t abstract policy debates but lifelines that preserve dignity and agency amidst increasing volatility.

Every dollar invested proactively generates exponential returns—not just economically but socially and politically—by preventing crises before they occur. By scaling successful pilots like RapidShield into sustainable programs, we can ensure that innovative climate finance continues reaching those who need it most.

The international community must act decisively—not only to stabilize insurance markets but also to address systemic vulnerabilities that threaten millions globally. For displaced populations facing existential risks daily, this isn’t just an opportunity—it’s an obligation.

Realistic Predictions: The Road Ahead

The future will be challenging:

Insurance companies are likely to reduce or withdraw coverage in high-risk zones, making parametric insurance and innovative risk financing indispensable.

These firms will probably engage consulting powerhouses like McKinsey to craft long-term survival strategies (for the next 50-100 years) for the industry amid escalating climate risks.

Without urgent action, vulnerable populations—including refugees in northern Uganda—will face worsening food insecurity, health crises, and displacement.

Nice-to-Haves: The Aspirational Horizon

Looking beyond immediate crises, I envision:

Robust investments in climate resilience and adaptation becoming standard practice.

Stabilized population movements whereby vulnerable communities would gain tools and knowledge to withstand climate shocks reducing the risk of forced or onward displacement

Reduced intersectional vulnerabilities—food insecurity, health disparities, gender inequities—through sustainable, inclusive funding.

Recognition and compensation for loss and damage, ensuring climate justice is central to global responses.

Interested in learning more about inclusive, strategic climate resilience solutions? Connect with me on LinkedIn – I'd be delighted to receive your connection request.

I'm always available to discuss how we can collaborate on creating more inclusive approaches, whether you are:

An insurance provider: Looking to develop inclusive, innovative products that address climate risks for vulnerable populations or seeking expertise on parametric insurance design that ensures equitable protection against climate-induced displacement.

A donor or philanthropist: Wanting to maximize impact through strategic, inclusive deployment of resources in climate adaptation and resilience initiatives, or exploring blended finance approaches to scale solutions for all communities.

A humanitarian organization: Seeking to strengthen your climate risk management capabilities with inclusive frameworks or integrate anticipatory action approaches that leave no one behind.

A government agency: Interested in developing comprehensive and inclusive climate resilience strategies that protect vulnerable communities while strengthening national adaptive capacity across all population segments.

The climate crisis demands collaborative, innovative and inclusive financial solutions that center the needs of the most vulnerable. Let's work together to build resilience where it matters most, ensuring no community is left behind.

[1] https://www.theguardian.com/environment/2025/apr/03/climate-crisis-on-track-to-destroy-capitalism-warns-allianz-insurer

[2] https://www.degreespod.com/episodes/climate-crisis-breaking-insurance